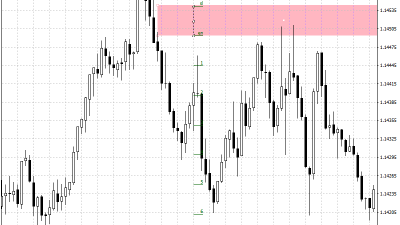

Forex trading, or foreign exchange trading, involves the buying and selling of currencies with the goal of making a profit. While technical analysis and market knowledge are crucial, the psychological aspect of trading often determines success or failure. Understanding and managing trading psychology is vital for any forex trader.

The Importance of Trading Psychology

Trading psychology refers to the emotional and mental state of traders and how it affects their decision-making process. Emotions such as fear, greed, euphoria, and anxiety can lead to irrational decisions that result in losses. Therefore, mastering trading psychology is as important as mastering trading strategies.

Key Psychological Factors in Forex Trading

- Discipline: Discipline is the cornerstone of successful trading. Traders must stick to their trading plan and avoid impulsive decisions. This includes setting and adhering to stop-loss and take-profit levels and not deviating from their strategy, even when the market behaves unpredictably.

- Patience: Forex trading requires patience, as opportunities do not arise every minute. Waiting for the right moment to enter or exit a trade can be challenging, but it is essential to avoid unnecessary risks. Patience helps traders to remain calm and avoid emotional trading.

- Emotional Control: Emotions can significantly impact trading decisions. Fear of loss can lead to closing positions too early, while greed can result in holding positions for too long. Traders must learn to manage their emotions and make decisions based on logic and analysis rather than feelings.

- Confidence: Confidence in one’s trading strategy and abilities is crucial. However, overconfidence can be dangerous and lead to reckless trading. Traders need to find a balance and maintain confidence without becoming complacent.

- Stress Management: The fast-paced nature of forex trading can be stressful. High levels of stress can cloud judgment and lead to mistakes. Effective stress management techniques, such as regular breaks, exercise, and relaxation practices, can help maintain mental clarity.

Strategies to Improve Trading Psychology

- Develop a Trading Plan: A well-defined trading plan outlines entry and exit strategies, risk management rules, and goals. Following a plan reduces emotional decision-making and keeps traders focused.

- Keep a Trading Journal: Recording trades, including the rationale behind them and the emotions experienced, can help identify patterns and improve future performance. Reviewing the journal regularly can provide insights into emotional triggers and areas for improvement.

- Set Realistic Goals: Setting achievable goals helps maintain motivation and reduces the pressure to achieve unrealistic profits. Realistic goals align expectations with actual market conditions and trading skills.

- Practice Mindfulness and Relaxation Techniques: Techniques such as meditation, deep breathing, and mindfulness can help traders stay calm and focused. These practices reduce stress and improve emotional control.

- Continuous Learning: The forex market is dynamic, and continuous learning is essential. Keeping up with market trends, new strategies, and psychological techniques enhances trading performance and confidence.

- Seek Support: Joining trading communities or working with a mentor can provide emotional support and valuable insights. Sharing experiences with others can help traders manage stress and learn from different perspectives.

Mastering forex trading psychology is a continuous process that requires self-awareness, discipline, and emotional control. By understanding the psychological factors that influence trading decisions and implementing strategies to manage them, traders can enhance their performance and achieve long-term success. Remember, the market will always be unpredictable, but a strong psychological foundation will help you navigate it more effectively.

Comments